About DBS

DBS provides a full range of services in consumer, SME and corporate banking activities. The bank has also been named “Safest Bank in Asia” by Global Finance for seven consecutive years from 2009 to 2015.

DBS currently has the largest number of online banking and mobile banking customers in Singapore. Mobile banking accounts for over 60% of the bank’s more than 500,000 daily logins.

Over the past three years, DBS has poured in about $500 Mn globally for a digital transformation. India is the first country where DBS has launched the mobile-only bank, digibank.

DBS digibank – Business objectives

Fast-paced changes in technology replaced paper with computer files, bank tellers with automated teller machines (ATMs) and file cabinets with server racks. And now, bank branches are being replaced with the mobile phone.

For leading Indian private banks, Internet and mobile based transactions have increased from 13% of total transactions in 2005 to a whopping 63% in 2015. According to the RBI mobile banking transactions are growing at 135% year on year.

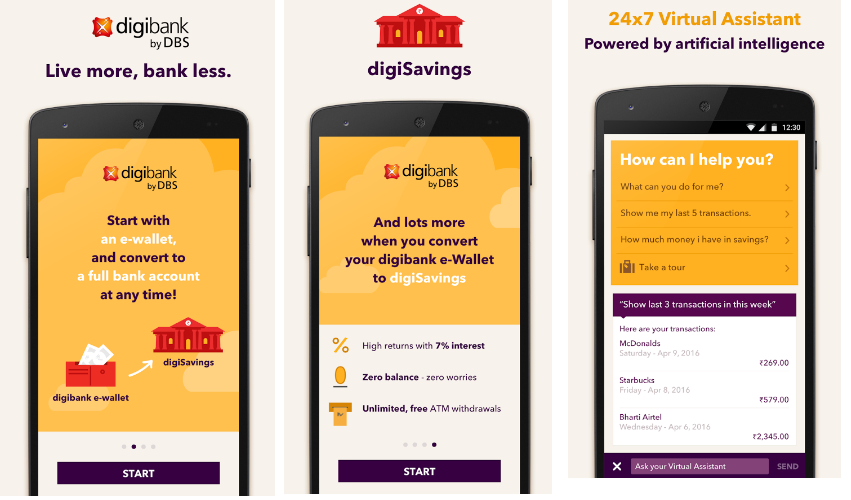

With a billion Aadhaar cards and over 200 million smartphone users in India, the opportunity for growth with digibank is huge. Breaking away from conventional banking norms with their onerous form-filling and cumbersome processes, digibank from DBS is a completely paper-less, signature-less and branch-less bank. The customer authentication is purely done using the Aadhaar card / PAN card. The bank account can be wholly operated through cutting edge mobile technology.

Since 2014 DBS has rolled out various initiatives to weave banking into the everyday life of its customers so that they can spend more time doing the things that they care about. Thus a fitting digibank tag line #live more.bank less.

At present, the bank’s cost to income ratio is 55% in India which it aims to bring down to its average of 45% globally. Introducing a revolutionary AI (interactive and intuitive) virtual assistant is a step in the direction to enable customer delight along with keeping cost to income low.

DBS aims to add over 5 Mn banking customers in India over the next five years. It aims to build a liability book of $7.5Bn (INR 50,000 Cr) and an asset book of $1.5Bn (INR 10,000 Cr) in the next three years on this platform. The immediate objectives since its launch in March’16 is to get a widespread awareness of the benefits of the offering. Then convert this interest into app downloads, e-wallets and savings accounts.

Approach / Strategy adopted by DBS

A DBS Digibank wallet can be opened by downloading an app in 90 seconds. For a savings account one has to provide a fingerprint authentication over a coffee at any one of the 500 designated Cafe Coffee Day outlets across the country. The bank is in talks to have more centres for biometric authentication.

DBS will provide customer service through a 24×7 artificial intelligence-driven virtual assistant, which understands natural language and has learning ability, in order to respond in real-time. The digital bank will also come equipped with an intuitive budget optimiser that will enable customers to do their budgeting, track expenses, analyse purchasing trends and also give investment advice.

The features include a superior 7% interest rate on savings, debit card with access to over 200,000 ATMs and no minimum balance requirements.

A good product was accompanied by a meticulous marketing strategy implementation.

Launch events with CEO, Piyush Gupta (in image) and awareness marketing like print, TVCs and IPL sponsorships were well blended with digital marketing engagement and creativity.

Launch Conference and Event on youtube with features and benefits in snippets called – Where’s Sachin ?

Above The Line marketing (ATL) awareness though print and television commercials were done on a national scale to target the mobile, technology friendly mass affluent segment.

The website of digibank, www.dbs.com/digibank/in, is a great achievement in differentiated branding, product offering, feature explanations and deals. It gives the customer the impression that banking can be fun, easy and simple not tedious, boring and complicated. The website alone is a winner in digital marketing implementation.

Facebook usage was very productive in spreading the simplicity, ease and benefits through the earnest endorsements of Sachin Tendulkar and creative animated communication through Digor.

Each benefit was given focused coverage on social media including facebook and twitter. Brand endorsements, the mascot and events helped to magnify the digital marketing effectiveness previously unheard of in the Banking sector.

Interest generated by way of opt-ins or download of the app would lead to a very focused e-mail campaign. The intention is to up sell from the e-wallet to a savings account.

If one is yet to transact on the digibank platform but has signed in as a customer, due to maybe reluctance, an e-mailer like the one on the left may be received outlining the importance of safety in digital banking.

These focused e-mails to customers who have opted-in would focus on one benefit at a time with a clear and detailed explanation.

Additional communication on offers on e-commerce deals or social media contests to meet IPL stars during matches added visibility and real time downloads and conversions.

Tell us why you want to meet the @RPSupergiants & we might just fly you down to Kolkata . https://t.co/50WPnTPTts pic.twitter.com/DlOvv97Igo

— digibank by DBS (@digibank) May 7, 2016

Results Achieved

The marketing implementation did well to launch, generate interest, explain features / benefits and convert that interest into app downloads and potential customers.

The initiative has achieved 300,000 downloads since March’16 and counting.

The buzz around #Live more.Bank Less is gaining momentum on social media by the day and adding customers to the learn about the digibank platform.

With the soft launch of digibank in August’15 and addition to the DBS portfolio by acquisition through digibank, the profitability of DBS India is back in the black.

Learning

- Very good use of the marketing mix with traditional and digital channels being allocated to what they do best.

- Timing of the offering ideal with a first mover digital advantage.

- Risks mitigated as the market has been tested for safety in digital and mobile banking channels.

- Persistent, educational, interactive use of social media and post sign-up e-mail marketing to deepen the relationship.

- Even traditional sectors like banking will benefit if they step up on the digital platform and not treat it as a add-on channel.

- Real time feedback on offerings and providing customers relevant discounts and deals for a fast conversion turn around.

- With many firsts, is this a “Whatsapp moment in Banking” ?

Photo Credits – digibank facebook page, dbs website, emails from digibank