Introduction

While digitally marketing FinTech brands, it is important you maintain few important guidelines to ensure stability and growth for your company. Especially during a time when FinTech is booming but Banks are still taking time to catch on.

As Wealthfront CEO Andy Rachleff said at in an interview with Fortune Live

“It is business models that disrupt companies not technology”

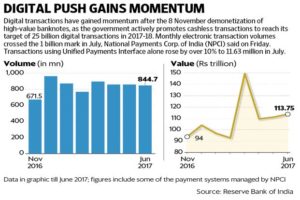

In India, Digital transactions are skyrocketing ever since demonetization. The government promoting cashless transactions through UPI –Unified Payment Interface (A system for instant fund transfer between bank accounts on mobile)

Guidelines

1) Security

With every Ying, there is a Yang. So when there is an increase in digital transactions in apps and websites, there is an expected increase in cyber crime as well.

As Pavan Duggal, president at Cyberlaws.Net and an advocate in the Supreme Court, said

‘After demonetisation, cyber crime has grown manifoldly and we have not been able to identify the extent to which it has grown.”

While digitally marketing FinTech brands , you can always expect a lack of trust in the audience mind before making a purchase. It is important to make them feel secure during this stage.A simple error or delay can cause a potential customer to completely rethink their purchasing decision.

If an infiltration happens even once and someone looses their money, it could mean the end of your company.

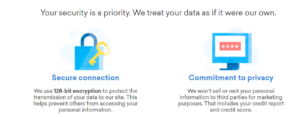

Below are few examples of what other FinTech companies are showcasing on their websites, to inspire confidence with their customers.

You can take this one step further by have your leadership invest in new security technologies and display them on your homepage itself. Include these new technologies in your strategy while marketing FinTech solutions.

A common trend you would notice, is that all these websites focus on their security in the homepage itself. Not hidden in another section or only shown at the final transaction stage.

Marketing the confidence in your companies ability to handle secure transactions, builds immense trust.

Trusting their transactions with you, is the first impression that your company needs ace at, and this requires you to display it the best informative way possible.

2) Offer Something Unique to B2B clients

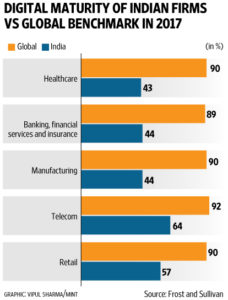

Pro – Companies are now at a scare to quickly keep up with global trends for digitizing themselves

A recent report published by livemint.com showcased that retail banking may loose nearly 55% of business to FinTech start-ups.

Con – A simple question, why do they need to invest in you?

Remember, don’t just follow the basic checklist every FinTech company needs to follow and stay put.

A large bank or company has more than enough capital, to invest in a secure digital transnational system themselves.

It doesn’t necessarily mean offering a new technology, but improving an existing process in a smoother and faster way can sometimes be all you need.

Make that message loud and clear.

3) Easier can be better than New

Further Elaborating, New technologies are good but they require time to build trust in the eyes of the public. Instead focus on improving existing financial systems/process to run faster or more efficiently.

Below are few examples of rising FinTech brands

– Lendr uses artificial intelligence to act as a reverse auction platform for mortgages. It replaces the lengthy and expensive process for borrowers and lenders, providing advice, digital identity and information services to streamline onboarding and a way for applicants to receive the best offer.

– Co-founder of Capitalise Paul Surtees has built technology that enables SMEs(small/medium-sized enteprises) and their advisors to find, compare and select the best lenders available to them – allowing them to access the funding available.

The platform matches SMEs with lenders, who are ranked based on their past successes. Surtees told the startup stage that “SMEs will typically limit their access to finance, they’ll leave only seven days to get the funds they need, spend less than one hour researching,and they’ll apply to one lender.”

– Another common issue financial institutions face , is cross country transactions. Setting up institutions to bank across borders can be expensive. To respond to this Transferwise was created.

A system where borderless accounts can be created and not constrained by countries or currencies, thereby giving business more freedom and control in their respective markets.

With the borderless account, users in the UK and Europe can keep money in 15 different currencies and have local account numbers for the UK, Europe and the US.

4) Chatbots – Required Automation While Marketing FinTech

You have seen them present in a majority of sites that contain transactional property. They are already being used for client on-boarding, internal/external money transfers, bill payment, payee addition/modification, P2P and recurring payment setup, data and alerts and real-time financial market data etc.

Setting up and monitoring automated chatbot interactions on your homepage, is now becoming an integral component of handling potential new customers.

K2 Bank, for example, is an independent bot that provides advanced banking features through its own conversational platform. This means that you don’t have to wait for your bank to catch up and create a chatbot.

Snatchbot, similar in nature, provides customers to create their own bots for their business. Users can customize and monitor their bots for their individual business respectively

Efficiency and speed is a necessary showcase feature while digitally marketing FinTech. Integrating an automated chatbot, to handle customer queries in real time, will improve the conversion ratio on your website.

Learn more about the scope of Artificial Intelligence and Digital marketing here

5) Efficiently Utilize Social Media

Saying that does not mean doing the bare minimum ie building a Facebook page, responding to comments, analyzing and creating a quarterly report with the data.

Social media has combined with Marketing FinTech strategies at a whole new level and its up to you as a digital marketer to utilize it efficiently.

Use of Social Influencers

Apart from keeping you up to date on latest finance trends, Social influences command a certain level of industrial authority in the finance segment. This enables them to spread ideas and knowledge about new FintTech Companies, to a larger relevant audience at a faster rate.

Leveraging these influencers by having them include your company in blog posts or videos will help you drive in a large number of potential customers.

Current top 5 FinTech social influencers are

- Mike Quindazzi @MikeQuindazzi

- Jim Marous @JimMarous

- Spiros Margaris @SpirosMargaris

- Brett King @brettking

- Andreas Staub@andi_staub

(Based on a report by Jax Finance https://finance.jaxlondon.com/blog/fintech-conference/top-20-social-influencers-fintech-2017/)

Learn more about Influencer Marketing in 2017

Get creative with your social media data

American Express Won awards at the 6th Annual Shorty Awards for being able to link Facebook accounts of customers, with their respective AMEX cards and tailoring deals based on the data driven from their social media account.

They did this back in 2013 as a strategy while marketing fintech solutions!

Point is, when looking to stand out it isn’t necessary to create something new. You can just get creative with the data you have and the knowledge of your buyer personas.

6) Mobile Wallets – The Need and How well can you showcase it?

Like a record player on repeat, as a digital marketer you will hear a non stop roar on how important mobile friendly marketing is and the constant need for it . But lets take some data first.

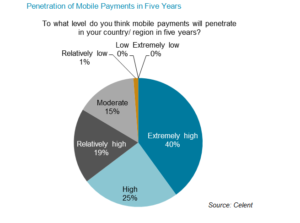

In a The State of Mobile Payments in Asia-Pacific: The Impact of Fintech, by KyongSun Kong.

She has said “Mobile payment markets in Asian countries are diverse, and the level of growth and speed of adoption of FinTech vary,” Kong said. “However, there is no doubt that every country is progressing step by step.”

About 80 per cent of respondents to her survey said FinTech plays an important role in the Asian mobile payments market.

Digitally Marketing Mobile Wallets

The need for faster online purchases in the most convenient way, is always growing.

Currently the rising trend is to store credit/debit card card information on an online wallet to be used in a variety of stores or online purchases ie Mobile Wallets

But how can you showcase this concept better when marketing fintech brands?

Just look at how ANZ – Australia’s 5th largest listed company and number one bank in New Zealand, promoted mobile wallet payments.

People understand mobile wallets. It is your job as a digital marketer to showcase the need for them. Utilize your current tie ups with stores and brands. To visitors, Display the convenience of making transactions with them through your company.

Ideally, in a manner the showcases the practical convenience more than anything else.

7) Chargebacks – A Common Bane, When Marketing FinTech Brands

If you were working at something apart from FinTech, you could probably deal with this by putting a standard refund policy somewhere on your website.

However when marketing FinTech brands, having a definite clear policy for chargebacks, can dramatically affect the losses to your company incurred by them.

Initially, created to protect consumers from fraudulent merchants.

Chargebacks now stand in a gray area between customers, who have legitimately lost money over a fraudulent transaction or product and people just looking to get their money back after a valid purchase.

The Cost Of Chargebacks to your company

Someone on the outside might think

“Let me just set up an automated system,put a refund policy and be done with it”

Let’s put little data to the above thought.

Ina recent interview with Monica Eaton-Cardone [ co-founder and COO of Chargebacks911, as well as the CIO of Europe’s Global Risk Technologies] on Chargebacks by thepayprs

She says

“Chargeback fraud is a critically serious problem, but receives a small fraction of the media attention of identity fraud. And that’s a real shame, because identity fraud costs businesses USD 2.7 billion annually, but chargebacks and chargeback-related expenses costs businesses more than USD 40 billion each year”

You can read the full article here

All chargeback’s aren’t the same. And all need to be handled in their respective manner as efficiently as possible, to the customer, bank or merchant businesses.

Without a clear yet fluent method to handle various kinds of chargebacks, Friendly fraud –Where a customer demands a refund even when a valid product/service was met – will only rise.

If a customer gets away with this process even once, chances are they will commit this again.

Alternatively, if you provide a very strict or no refund policy to your customers, you might loose on potential customer due the lack of customer protection.

It is your job as a digital marketer to address possible transactional errors in a clear authoritative way on your website/app. That also simultaneously doesn’t dissuade a potential customer from making a transaction due to the lack of trust,

3 basic things to remember for dealing with chargebacks

- Have extensive and transparent documentation ready for anything sales related

- Customer Service should have a friendly face and top notch during the entire sales process

- For B2B it is important to showcase your stand on handling chargebacks. Customers will be primarily looking at how efficiently your company handles chargeback cases and your solutions to them

8) News and Trends – Why keep your visitors informed

It builds a massive amount of trust when a customer views a finance related Article or post from your brand. Keep your customer up to date with the latest trend, problems and solutions.

It also helps you direct your customers towards a new service or product. Even by talking about a problem that your company has already solved.

This is one of the age old methods of digital marketing for various industries, but was still very valuable then and now as well.

Image Credits

www.creditkarma.com, www.biocatch.com, www.livemint.com, snatchbot.me/ecommerce, www.paypal.com, www.payubiz.in, cityfalcon.com, transferwise.com, bluenotes.anz.com