About ICICI Bank

ICICI Bank is India’s largest private sector bank with total assets of Rs. 6,461.29 billion (US$ 103 billion) at March 31, 2015 and profit after tax Rs. 111.75 billion (US$ 1,788 million) for the year ended March 31, 2015. ICICI Bank currently has a network of 4,070 Branches and 13,269 ATM’s across India.

ICICI Bank’s Business Objectives For Digital Space –

ICICI Bank—an institution has projected itself as a first-mover on many fronts—the changing banking landscape, where digital delivery of services is becoming more the norm than a nice thing to do, and has always maintained an aggressive digital strategy realizing the potential. It’s business objectives for digital marketing can be summarized as below –

- Engaging customers with the brand at their convenience

- Explore new technology strategies, maintaining its competitive edge.

- Youngsters spend a lot of time on social media platforms like Facebook and Twitter, and most often complete the social part of the transactions there, whether it’s a dinner or a movie. What ICICI is aiming to do is to help them complete the financial part of their transactions also on social media and attract younger customers to the brand.

- The Bank also utilizes this space to manage its online reputation. This involves monitoring and generating online feedback and reviews, responding to customer complaints, resolving queries, taking corrective action on incorrect information and using online feedback to guide improvements in product development for enhancing customer experience. Interact in real conversation with prospective customers and fans.

Approach / Strategy adopted by ICICI Bank

ICICI Bank has been doing an excellent job with is overall Social Media Strategy! It is one of the few banks from the Indian financial industry to embrace social media in such a nice way to connect with its consumers. ICICI’s Social friendly strategy is doing a bang up job of building a community of loyal fans around itself job on three platforms – Facebook, Twitter and YouTube. It is innovative in tapping onto new customers in the market.

Facebook:

ICICI Bank goes beyond marketing on its Facebook page. It is not only listening to customers its but also engaging with them with appealing updates like interesting world currency facts, helpful updates, puzzles and quiz, ICICI’s offline activities, etc. It is also leveraging Facebook page for Customer Service with a special tab that assists the customer with all the helpful information and customer care numbers. There have been efforts to drive traffic to its website through engaging Facebook apps.

Twitter:

ICICI’s every tweet has a human touch unlike most other banks who sound like automated answering machines. @ICICIBank_Care is effective in creating and sustaining communication on Twitter. The way ICICI bank responds to concerns on the spot and encourages interaction in a friendly manner gives it a great networking opportunity and an edge over other financial institutes.

YouTube:

There is a very good content on ICICI Bank’s YouTube channel. There a number of insightful interviews about the economy, financial trends, inside stories, ICICI’s offline activities, testimonials, etc.

Results Achieved by ICICI Bank

These digital marketing initiatives are helping the bank get new customers, as well as optimising revenue among existing ones. The bank has improved customer satisfaction and increased positive perceptions social media

- The bank is likely to end FY16 with Rs 80,000 crore worth of transactions from mobile banking alone

- With more customers getting access to digital options, close to 60 percent of the bank’s total transactions for savings account customers are now undertaken through new-age digital channels, and only 10 percent by way of branches. In FY2015, the share of current and savings accounts (CASA) for the bank was 3 percentage points higher at 46 percent, compared to the previous fiscal, indicating a healthy increase. With digital channels reducing costs, the bank’s cost-to-income ratio has also improved to 36.8 percent, down from the previous fiscal’s 38.2 percent.

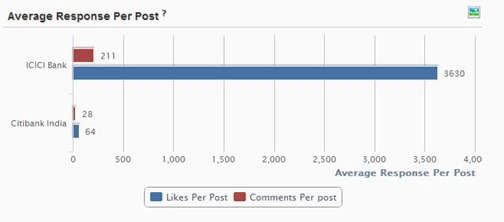

- Most-engaged Indian banking brand on Facebook. They built a 950,000 Facebook community within 10 months and currently have 4million+ followers.

- The YouTube channel acquired over 100,000 views in less than a year. The pockets videos logged 3.3million views in the last 2 months.

- ~39% (http://www.similarweb.com/website/icicibank.com#referrals) of customers that go to ICICI’s website go through referrals which is proof that digital marketing is working extremely well for the bank.

-

Pockets –

ICICI bank was able to launch a new product for the digitally aware customer – Pockets as a mobile wallet. The app is convenient and user-friendly. This innovation is in line with ICICI’s philosophy of ‘Khayaal Aapka’ wherein the bank offers products and services which make banking easier and more convenient for customers. The app offers social activities for friends and families such as planning outings and films with friends on Facebook

Learnings

Consumer in the digital age does not have patience to wait for too long. At the same time it is very important of a financial institution to create transparency by winning the faith of its stake holders. Humans want to interact with humans and not spammy bots! Just having a presence without real time updates and ways to engage prospective customers is a recipe for failure as some of the other competitors like Axis bank and Citi bank have found.

Gaming by way of contests, quizzes and poles that urges users to know more about the services ICICI provides is a sure shot way to entice a new customer and retain the loyalty of existing ones. Do not do just self-promotion but offer means to engage users.

Analyze the comments from users to look for trends to understand the customer sentiment better. This could help identify problems much earlier and do a course correction for a better customer experience and more business in the long run.

Photo Credits: socialsamosa, icicibank