Credit risk modelling is the best way for lenders to understand how likely a particular loan is to get repaid. In other words, it’s a tool to understand the credit risk of a borrower. This is especially important because this credit risk profile keeps changing with time and circumstances.

To quote credit union training consultants Dennis Child and Randy Thompson: “We in the lending business witnessed how dramatically loan portfolios can change over relatively short time frames, and how detrimental those changes can be.”

What is Credit Risk?

Credit risk refers to the chance that a borrower will be unable to make their payments on time and default on their debt. It refers to the risk that a lender may not receive their interest due or the principal lent on time.

This results in an interruption of cash flows for the lender and increases the cost of collection. In extreme cases, some part of the loan or even the entire loan may have to be written off resulting in a loss for the lender.

It is extremely difficult and complex to pinpoint exactly how likely a person is to default on their loan. At the same time, properly assessing credit risk can reduce the likelihood of losses from default and delayed repayment.

Interest payments from the borrower are the lender’s reward for bearing credit risk. If the credit risk is higher, the lender or investor will either charge a higher interest or forego the lending opportunity altogether. For example, a loan applicant with a superior credit history and steady income will be charged a lower interest rate for the same loan than an applicant with a poor credit history.

What is Credit Risk Modelling?

There are many different factors that affect a person’s credit risk. This makes assessing a borrower’s credit risk a highly complex task. With so much money riding on our ability to accurately estimate the credit risk of a borrower, credit risk modeling has come into the picture.

Credit risk modelling refers to the process of using data models to find out two important things. The first is the probability of the borrower defaulting on the loan. The second is the impact on the financials of the lender if this default occurs.

Financial institutions rely on credit risk models to determine the credit risk of potential borrowers. They make decisions on whether or not to sanction a loan as well as on the interest rate of the loan based on the credit risk model validation.

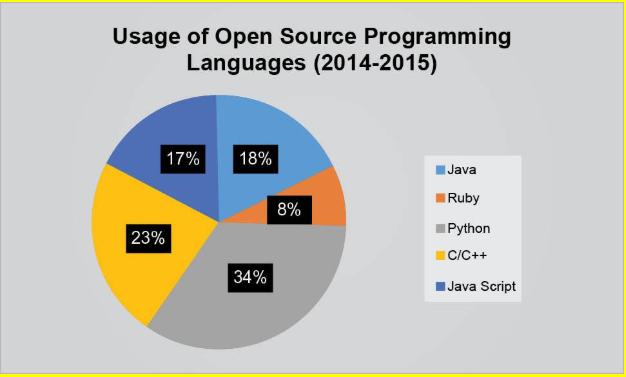

As technology has progressed, new ways of modeling credit risk have emerged including credit risk modelling using R and Python. These include using the latest analytics and big data tools to model credit risk. Other factors like the evolution of economies and the subsequent emergence of different types of credit risk have also impacted how credit risk modelling is done.

Different Types of Credit Risk

There are a number of different types of credit risk which arise based on the type of loan and the situation. Obviously, different credit risk models work better for different kinds of credit and credit risk model validation differs accordingly. Here are some common credit risks that lenders undertake.

- There is a risk that an individual borrower may fail to make a payment due on a credit card, a mortgage loan, line of credit, or any other personal loan.

- A business or individual fails to pay a trade invoice on the due date. This is a common risk that both B2B and B2C businesses that work on credit carry.

- A company that borrows money is unable to repay fixed or floating charge debt.

- An insurance company that is insolvent does not make a claim payment which is due.

- A company or a government may have issued a bond that it does not pay the interest or principal amount on.

- A business does not pay an employee’s salary or wages when they become due.

- A bank that is now bankrupt doesn’t return money that has been deposited.

Which Factors Affect Credit Risk Modelling?

The risk for the lender is of several kinds ranging from disruption to cash flows, and increased collection costs to loss of interest and principal. That’s why it’s important to be able to forecast credit risk as accurately as possible. Credit risk modeling depends on a variety of complex factors. That’s why it’s important to have sophisticated credit risk rating models.

There are several major factors to consider while determining credit risk. From the financial health of the borrower and the consequences of default for both the borrower and the creditor to a variety of macroeconomic considerations. Here are three major factors affecting the credit risk of a borrower.

(i) The Probability of Default (PD)

This refers to the likelihood that a borrower will default on their loans and is obviously the most important part of a credit risk model. For individuals, this score is based on their debt-income ratio and existing credit score.

For institutions that issue bonds, this probability is determined by rating agencies like Moody’s and Standard & Poor’s. The PD generally determines the interest rate and amount of down payment needed.

(ii) Loss Given Default

This refers to the total loss that the lender will suffer if the debt is not repaid. This is a critical component in credit risk modeling. For instance, two borrowers with the same credit score and a similar debt-income ratio will present two very different credit risk profiles if one is borrowing a much larger amount.

That’s because the loss to the lender in case of default is much higher when the amount is larger. This again plays a big role in determining interest rates and down payments. If the borrower is willing to offer collateral then that has a big impact on the interest rate offered.

(iii) Exposure at Default

This is a measure of the total exposure that a lender is exposed to at any given point of time. This also has an impact on the credit risk because it is an indicator of the risk appetite of the lender. It is calculated by multiplying each loan by a certain percentage depending on the particulars of the loan.

Image Source

Types of Credit Risk Rating Models

Credit risk modeling depends on how effectively you can leverage data about a borrower’s financial history, income, and so on to arrive at an accurate credit score. Big data and analytics are enabling credit risk modelling to become more scientific as it is now based more on past data than guesswork. In fact, credit risk modeling using R, Python, and other programming languages is becoming more mainstream. Here’s an excellent video which discusses different credit risk rating models.

Of course, the ultimate credit risk model validation comes only after there are years of data to back the accuracy of a forecast.

Here are the three major types of credit risk rating models that are used to determine credit risk.

(i) The Models Based on Financial Statement Analysis

Examples of these models include Altman Z score and Moody’s Risk Calc. These models are based on an analysis of financial statements of borrowing institutions. They chiefly take into account well known financial ratios that can be useful in determining credit risk. For instance, Altman Z score takes into account financial ratios like EBIDTA/total taxes and sales/total assets in different proportions to determine the likelihood of a company going bankrupt.

(ii) The Models Measuring Default Probability

The best example of this kind of credit risk modeling is structural models like the Merton model. Structural models consider business failures to be an endogenous event which depends on the capital structure of the company. In other words, they operate on the assumption that a business will fail and default on its loans if its value falls below a certain threshold.

(iii) Machine Learning Models

The introduction of machine learning and big data to credit risk modeling has made it possible to create credit risk models that are far more scientific and accurate. A great example of this is the Maximum Expected Utility model which is based on machine learning.

While the MEU model was introduced as early as 2003, it has now incorporated several elements of machine learning to predict credit risk more accurately. In fact, many credit risk calculations including the famous FICO score are now adding score from machine learning models to score from traditional models to improve accuracy.

Conclusion

There are still a number of approaches to credit risk modelling and different approaches work better in different lending scenarios. Of course, credit risk modeling has also become more advanced, especially with newer analytics tools.

Credit risk modelling using R, Python, and other analytics-friendly programming languages has greatly improved the ease and accuracy of credit risk modeling. Credit risk modeling is still extremely niche and offers great career prospects for those who have a good grasp of analytics as well as the world of finance.

To build a successful career in Data Science, take up the Data Scientist Course today.

Have any doubts regarding credit risk modelling? Share your thoughts in comments.

Thank you for this article; there is a lot of detail.